The Importance of Teaching Kids About Money: A Critical Foundation for Their Future

As parents, we all want to raise children who are financially responsible, capable of making wise decisions with their money, and prepared to face the financial challenges of adulthood. Yet, when it comes to teaching our kids about money, many of us may not realize just how early the lessons need to begin. The reality is, the way we manage and talk about money influences our children’s understanding and relationship with it — and this can shape their financial futures.

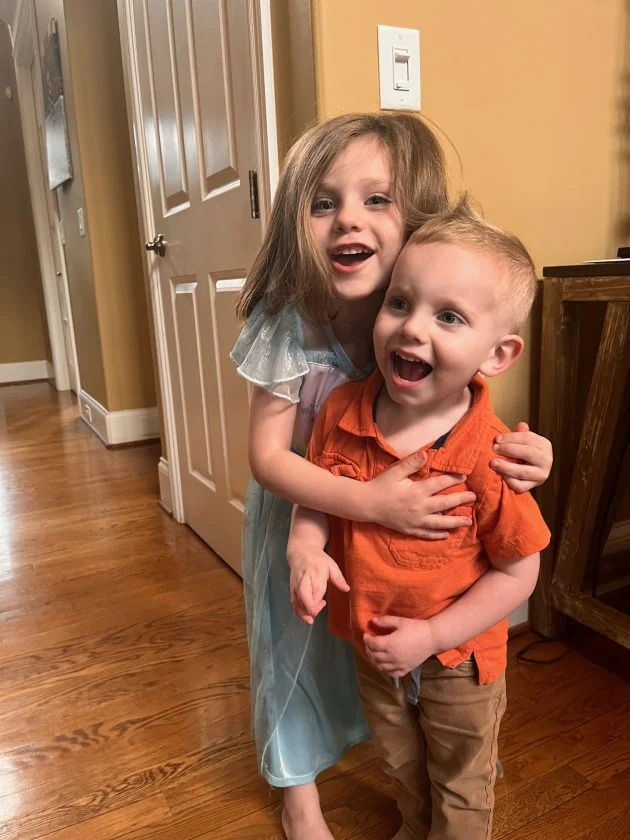

Recently, I had an experience with my 4-year-old daughter, Kierstyn, that served as a powerful reminder of why we need to start these conversations early. We’ve been trying to teach her about money in simple, tangible ways. We give her opportunities to earn money by doing extra chores, and we’ve discussed how we pay for things by earning and spending cash.

However, the other day, when Kierstyn wanted something that she didn’t have enough money for, she simply said, “Or you could just use your card to buy it.” That was a wake-up call. It became clear to me that she didn’t yet grasp the concept that a debit card is linked to actual money in our bank account. She thought the card was just a magical tool to get anything she wanted, without understanding the real-world connection between earning money and spending it.

This experience highlighted just how essential it is to have consistent, intentional conversations about money — even with very young children. Kids need to understand that money isn’t an abstract concept; it’s tied to hard work, planning, and choices. And it’s not just about the basics of earning and spending — it’s also about how we manage and talk about money in our homes. Our financial behaviors directly influence how our children will approach money when they grow older.

Why Teaching Money Matters

You might be thinking, “But they’re too young to understand all of this.” However, research shows that children as young as three or four can begin grasping basic money concepts, such as saving, spending, and earning. The earlier we start discussing money with our kids, the more likely they are to adopt healthy financial habits and avoid common financial pitfalls as they grow older.

Money isn’t just something to be talked about in high school economics classes or when they’re ready to open a bank account. We should be talking about it regularly, involving them in day-to-day decisions, and demonstrating our financial choices.

5 Key Money Mindsets to Teach Your Teen

If you’re unsure of where to start, here are five crucial money mindsets that can change the trajectory of your teen’s financial future:

1. Everything You Buy Costs More Than Just Money

It’s easy to fall into the trap of thinking that buying something is just about swiping a card or handing over cash. But every purchase comes with a cost beyond money — it’s the time you had to work to earn that money. Teaching your teen to consider the time investment in relation to what they’re buying can help them become more mindful of their spending choices.

2. Living Below Your Means is a Gift to Your Future Self

One of the most powerful habits you can instill in your teen is learning to spend less than they earn. By setting up a budget early and sticking to it, they’ll gain a significant advantage over their peers who may be living paycheck to paycheck. Encourage them to make thoughtful decisions about their spending and savings — this mindset will be invaluable as they face college and adulthood.

3. Compound Interest is a Powerful Tool

It’s never too early to teach teens about the benefits of compound interest. By starting to save small amounts of money in a high-yield savings account or an investment account when they’re young, they’ll be able to see firsthand how their money can grow exponentially over time. Encourage your teen to put away money they don’t need to touch for years — the earlier they start, the more their savings will snowball.

4. Master Your Money Now, Before You Have More

Many teens think that once they get a “real” job or have more money, they’ll suddenly be good at managing it. The truth is, the way they handle money when they have little is the same way they’ll handle it when they have more. Help your teen set up a budget, track their expenses, and stick to their financial goals. Managing money isn’t about how much you have, but how wisely you use what you’ve got.

5. Contentment and Creativity Lead to Financial Success

Impulse buying can quickly drain a budget, but teaching your teen the importance of contentment can help them avoid it. Encourage them to think creatively about how they can meet their needs and wants without overspending. Whether it’s learning how to DIY, finding deals, or simply learning to be content with what they already have, this mindset can save them hundreds, if not thousands, of dollars in the long run.

Start the Conversation Now

Money isn’t a topic that should be saved for later in life. Start small, and incorporate money talks into everyday activities. Whether it’s involving your kids in the process of budgeting for a family trip or simply talking about how you make financial decisions at home, you’re laying the foundation for a financially responsible future.

For teens, the earlier you teach them to budget, save, and plan, the more prepared they will be for the financial realities of adult life. But don’t worry if you don’t have all the answers — it’s not about being a financial expert. It’s about fostering an open dialogue, providing them with the tools and knowledge they need, and leading by example.

If you’re not sure where to start, I’ve put together a free resource that outlines 15 Financial Skills Every Teen Should Know. This guide will help you prioritize the most important financial lessons and give you practical tips for teaching your kids how to manage their money. From the basics to more advanced skills, this download will give you a roadmap for raising financially smart kids.

By focusing on these key money mindsets and continuing the conversation about money at home, you’re not just teaching your kids how to manage their finances — you’re setting them up for a lifetime of financial success. Start today, and give them the tools they need to thrive tomorrow.